Since solar energy is indispensable for the energy transition, people in Europe can now look forward to more photovoltaic subsidies. The Renewable Energy Sources Act (EEG) has been revised and should convince more people in Europe to invest in solar energy. But Switzerland also has a range of attractive subsidies for photovoltaic systems. In this article, we take a detailed look at the photovoltaic subsidies for Germany and Austria, Belgium and France as well as the subsidies for Switzerland.

General trend for the promotion of photovoltaics (EEG 2023)

The trend of the EEG is to simplify the subsidies and make them accessible to more people. Furthermore, the level of remuneration is to be made more attractive so that the installation of a photovoltaic system is worthwhile for more people. The EEG 2023 aims for a massive expansion of renewable energies. This year, the target is 7 GW (gigawatts). Next year, 9 GW of renewable energy are to be added. The expansion is therefore to be progressively increased each year. By 2026, the target is 22 GW. Although all plants will qualify for the increased photovoltaic subsidy from 30 July 2022, the higher remuneration will only be paid by the government from 1 January 2023.

Summary: What is new in the EEG 2023?

- The new draft legislation of the Renewable Energy Sources Act (EEG) improves and simplifies a number of things for users and producers of solar power.

- Most of the regulations will not take effect until 1 January 2023 or after approval by the EU Commission.

- The feed-in tariffs will be increased, but they will not be paid out until after the EU Commission has given its approval. Anyone who commissions a photovoltaic system before then will receive an additional payment after the approval.

- If the roof of the house is not suitable, photovoltaic systems on garages, carports or in the garden are also subsidised.

Situation in Europe: Germany & Austria

The EEG 2023 will bring some changes to photovoltaic support into force, for example grid requests will be standardised and digitalised. With the new draft law, photovoltaic support will finally reach the digital age. Here is an overview of all the changes:

Simplification for already existing installations

The new EEG contains some simplifications. The EEG levy is to be abolished. The change will significantly simplify billing for electricity sales. As a result, the generation meter can be dispensed with.

Self-consumption no longer mandatory

Systems built from 1 January 2023 onwards can now feed their entire output into the public grid. The restriction of a maximum of 70 percent of the nominal PV power was discontinued. Therefore, the obligation for a generation meter is no longer required for these systems.

No more degression for delayed commissioning

Previously, delays in commissioning resulted in lower feed-in tariffs. However, this regulation has been suspended. The monthly reduction of the feed-in tariff, also called degression, is suspended until 2024. The feed-in tariffs will therefore remain constant in 2022 and 2023.

The aim of the photovoltaic subsidy: photovoltaic systems are also to be built if no or only a small part of the energy is required for self-consumption. Plants that exclusively feed into the public grid have not been worthwhile so far.

New remuneration rates after EU approval

However, the new remuneration rates will only apply to plants from 30 July 2022 after the EU Commission has given its approval. It has not yet been clarified when this will be the case.

Level of the new remuneration rates

- Systems with a self-sufficiency share now receive the following feed-in tariff:

- Systems up to 10 kWp receive 8.2 cents per kWh. For larger systems, the system part from 10 kWp receives 7.1 cents per kWh.

- Plants that feed all their energy into the public grid receive a higher payment.

- Systems up to 10 kWp receive 13.0 cents per kWh. Larger installations receive 10.9 cents per kWp for the remainder of the installation.

- In order to benefit from the increased feed-in tariff, you must notify the grid operator in 2022 before commissioning the system that it is to be operated in full feed-in mode.

Photovoltaic subsidies now also available for garages and gardens

In future, you can also benefit from the subsidy for photovoltaic systems with an output of up to 20 kilowatts, even if they are not installed on the roof of your house. The condition for this is proof that your house roof is not suitable for a solar installation. Then a photovoltaic subsidy can also be used on a carport, a garage or in the garden. In this case, however, a building permit from the municipality is also required.

Situation in Europe: Belgium & France

The prosumer tariff in Belgium

The system has just been harmonised in Wallonia, joining Flanders and the Brussels region. The prosumer (the owner of a photovoltaic installation) benefits on the one hand from his self-consumption, but also from an injection tariff for the excess electricity he injects into the grid. It is therefore in his interest to equip himself with batteries to optimise his self-consumption.

These injection tariffs are not regulated and are set freely by the suppliers. It is in the prosumer’s interest to play the competition because the tariffs are very different from one supplier to another.

The prosumer also pays a contribution to the network management costs of about 450€/year on average. This contribution is called the “prosumer tax” and is subsidised to the tune of 54%.

In addition, Flanders encourages photovoltaics by subsidising installations (solar panels or roofs) up to 750€ and the purchase of domestic batteries up to 850€.

A unique and regulated system in France

In France, private photovoltaic electricity producers can sell all or part of the electricity they produce. The feed-in tariffs are set by the government and change every quarter. This remuneration depends on 3 factors:

- The power of the installation

- The method of sale (all the electricity produced or only the surplus)

- The installation and landscape integration conditions (note that as of 5 July 2022, SunStyle is one of the three manufacturers eligible for the landscape integration premium in France).

For example: For a 3kWp PV installation, the producer receives 17.89 c€/kWh if he sells all of his production, or 10c€/kWh if he only sells the surplus (source economie.gouv.fr)

In order to encourage the energy transition, the French government has introduced an investment premium for installations that allow self-consumption. Ranging from 380 €/kWp (installation < 3kWp) to 80 €/kWp (installation between 36 and 100 kWp), the premium depends on the power of the installation.

Finally, grid-connected photovoltaic installations with a power of 3 kWp or less benefit from a reduced VAT rate of 10%.

Situation in Switzerland

Photovoltaic subsidies in Switzerland are made up of two parts. On the one hand, you get back about one third of the investment costs for photovoltaic systems up to 100 kWp through a one-time payment. In addition, you receive compensation from the electricity company for every kilowatt hour you feed into the grid. The amount of the payment depends greatly on the region. Some electricity providers also buy the certificate of origin for your solar electricity.

The market for green energy is growing

In Switzerland, more and more electricity suppliers are basing their feed-in tariffs on the current market value. The reference market value, which is calculated by the Swiss Federal Office of Energy (SFOE), is used as a guide. If one observes the trend of the reference market value, a positive price development can be observed. From 3.0 centimes per kWh in 2020 to 9.5 centimes per kWh in 2021 to 26.25 centimes per kWh in 2022. On the one hand, this means rising electricity prices for consumers due to market orientation, but also higher remuneration for producers. Which makes a photovoltaic system seem more and more attractive.

Conclusion: a photovoltaic system is worthwhile

Once again, the installation of a solar system on one’s own roof becomes more attractive due to the corresponding photovoltaic subsidies. Both the EU and Switzerland want to enable more citizens to switch to renewable energies for the energy transition. In Switzerland, this is done by means of a one-time payment, through which about one third of the costs are covered by the government. In the EU, the feed-in subsidies ensure that the system pays for itself more quickly. Thus, both regions offer different approaches to photovoltaic promotion and want to further promote the expansion of renewable energies in the private sector.

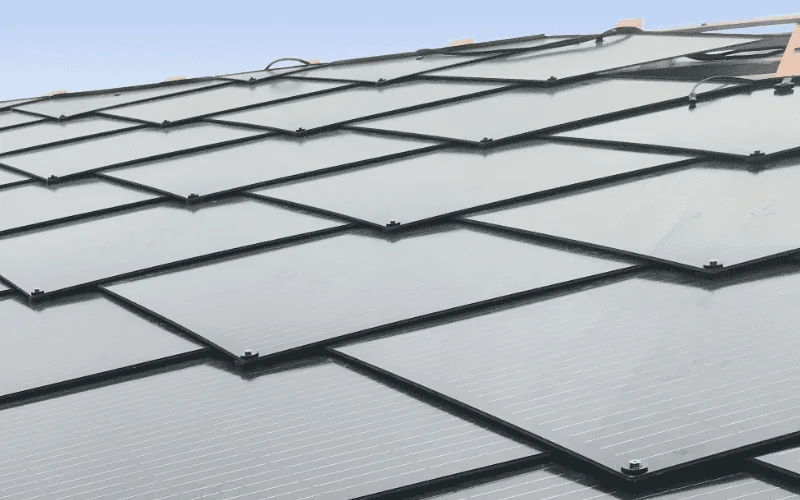

The advantages of SunStyle

In contrast to a classic photovoltaic system, SunStyle solar tiles are a highlight in the design of your house and are also a sensible option for listed buildings (e.g. churches, houses in the old town, buildings in the mountains, etc.). Due to the dragon scale design, SunStyle solar tiles provide you with an aesthetic solar roof that gives your house a noble value instead of devaluing it with a non-uniform appearance. In-roof photovoltaic systems also qualify for photovoltaic subsidies in Germany, Austria and Switzerland.

Are you thinking of switching to sustainable electricity or do you have a project that you need help with? Then contact us, we will be happy to assist you with individual advice. With our advice and service, we want to help more people invest in the sustainability of our planet.

For more information about SunStyle’s solar roof, visit sunstyle.com

Power your interest in the future of solar roofing by following us:

Instagram @sunstyle_solar

Facebook @sunstylesolar

LinkedIn linkedin.com/company/sunstylesolar

Youtube @youtube channel